Product

TABLE OF CONTENTs

TABLE OF CONTENT

Net revenue retention (NRR) is one of the most commonly used formulas for tracking revenue stability from existing customers.

And yet, there’s a lot of confusion around how to calculate NRR correctly and how it’s different from related terms like net revenue retention rate (NRRR), net dollar retention (NDR), and renewal rates.

That’s why, in this post, we’re going to share:

- What NRR is

- How it’s different from similar retention metrics

- How to increase NRR at your company

By the end of this article, you’ll have a clear idea of how to drive more revenue from your existing customer base.

For now, though, let’s dive into the basics by addressing the following question: what is net revenue retention?

What is net revenue retention (NRR)?

Net Revenue Retention (NRR) is a metric used to measure the growth or decline of revenue streams tied to existing customers within a given time period. While NRR includes expansion revenue, it doesn’t take growth from new clients into account.

NRR helps SaaS businesses and startups understand how much revenue they’re keeping from current customers.

Many people use NRR synonymously with other terms, such as net revenue retention rate (NRRR), net dollar retention (NDR), and others. Though similar, these terms carry unique differences that dictate which formula you should use to track retention.

Let’s start with calculating NRR and showing how that compares with NRRR.

How to calculate net revenue retention

The big thing to remember is that NRR is a raw figure expressed in monetary terms (unlike other formulas such as NRRR, which converts that figure into a comparable percentage).

Here’s a simple formula for calculating your NRR:

NRR = Starting Revenue + Expansion Revenue - Contractions - Churn

In this formula:

- Starting revenue is at the beginning of your financial period for a cohort of your existing customers.

- Expansion revenue is the additional revenue generated from the same customer segment during that period through upgrades and cross-selling.

- Contractions refer to revenue lost through downgrades.

- Churn is lost from current customers canceling their subscriptions.

So, for example, imagine a subscription-based company with the following data for April 2023:

- Starting Revenue: $100,000

- Expansion Revenue: $20,000

- Contractions: $5,000

- Churned Revenue: $10,000

Now we can calculate a rough figure for NRR:

NRR = Starting Revenue + Expansions - Contractions - Churn

NRR = $100,000 + $20,000 - $5,000 - $10,000

NRR = $105,000

In this example, the NRR for that month is $105,000.

Let’s turn our attention to what NRRR is and why it’s a more effective metric for companies.

What is net revenue retention rate (NRRR)?

Net revenue retention rate (NRRR) is a percentage that indicates how much revenue a company retains from its current customers over a given period.

But because it’s a comparable percentage (rather than a raw figure), you can more accurately see how retention contributes to overall growth.

How to calculate net revenue retention rate

To calculate NRRR, divide revenue at the end of a given period by revenue at the beginning of the same period, minus any new customer revenue. Then multiply the result by 100% to get your net revenue retention rate:

NRRR = (Ending Revenue - New Customer Revenue + Expansion Revenue) / Starting Revenue x 100%

Here’s a quick glossary of key terms:

- Starting revenue is generated from a cohort of existing customers at the beginning of a predefined time period.

- Ending revenue is generated from the same cohort of customers at the end of that period, including any upsells, cross-sells, downgrades, or churn.

- New customer revenue is generated from new customers acquired during the period, which should be excluded from the calculation.

- Expansion revenue is the additional revenue generated from existing customers through upsells, cross-sells, or other means during the period.

With this information on hand, you can calculate NRRR. Let’s walk through this formula step-by-step:

- Determine the starting revenue from your cohort of existing customers at the start of a month or year.

- Calculate the ending revenue from the same cohort of customers at the end of that time period, taking into account any upsells, cross-sells, downgrades, and churn. Exclude any revenue generated from new customers acquired during this period.

- Add the expansion revenue generated from existing customers to the ending revenue.

- Divide the resulting sum by the starting revenue.

- Multiply the result by 100 to express the NRRR as a percentage.

Let’s see a concrete (albeit fictional) example to clarify things.

Imagine a company that wants to calculate its NRRR for April. Here's the data they’re working with:

- Starting revenue (April 1): $50,000

- New customer revenue during April: $10,000

- Expansion revenue during April: $5,000

- Churned revenue during April: $2,000

- Downgraded revenue during April: $1,000

First, we need to calculate the ending revenue for April:

Ending Revenue = Starting Revenue - Churned Revenue - Downgraded Revenue + Expansion Revenue

Ending Revenue = ($50,000 - $2,000 - $1,000 + $5,000) = $52,000

And that allows us to calculate the NRRR:

NRRR = (Ending Revenue - New Revenue + Expansion Revenue) / Starting Revenue x 100%

NRRR = ($52,000 - $10,000 + $5,000) / $50,000 x 100%

NRRR = $47,000 / $50,000 x 100%

NRRR = 94%

In this example, the company’s NRRR for April is 94%.

They’ve retained 94% of the revenue generated from existing customers at the beginning of April, despite any churn or downgrades, and taking into account expansion revenue.

While this is a strong NRRR, there’s room for improvement, as the goal is to have a rate exceeding 100%. This would signal that you’re growing revenue through existing customers through upsells/cross-sells and subscription upgrades.

Why do net revenue retention rates matter? (with an example)

Calculating NRR is better than nothing, but it’s more misleading than converting that number into a percentage for your NRRR.

Imagine a software company that wants to calculate its net revenue retention rate (NRRR) for April last year and compare it with April this year.

If this were last year's data:

- Starting revenue: $160,000

- Ending revenue: $180,000

- New revenue: $20,000

- Expansion revenue: $10,000

- Churned revenue: $5,000

- Downgraded revenue (contractions): $5,000

And this were this year's data:

- Starting revenue: $220,000

- Ending revenue: $270,000

- New revenue: $60,000

- Expansion revenue: $20,000

- Churned revenue: $10,000

- Downgraded revenue (contractions): $10,000

Here's how we'd calculate NRR for both years

NRR from April last year

NRR = Starting Revenue + Expansion Revenue - Contractions - Churn

NRR = $160,000 + $10,000 - $5,000 - $5,000

NRR = $160,000

NRR from April this year

NRR = $220,000 + $20,000 - $10,000 - $10,000

NRR = $220,000

Looking at the NRR figures, the company's growth is impressive, as the NRR increased from $160,000 to $220,000.

But when calculating the net revenue retention rate (NRRR), you get a more accurate picture of the company's performance:

NRRR = (Ending Revenue - New Revenue + Expansion Revenue) / (Starting Revenue) x 100%

Last year's NRRR = ($180,000 - $20,000 + $10,000) / $160,000 x 100% = 106.25%

This year's NRRR = ($270,000 - $60,000 + $20,000) / $220,000 x 100% = 104.55%

The NRRR shows that the company's growth in terms of retaining and upselling existing customers isn’t as remarkable as the raw NRR figures suggest.

In fact, NRRR has slightly decreased, indicating that the company might need to focus more on customer retention and upselling strategies.

NRR vs. Net Dollar Retention (NDR)

Net Dollar Retention (NDR) focuses on the value of a customer in their first month or year with your business. It’s another key metric to analyze customer retention that often gets confused with NRR.

Though similar, NRR looks at your entire existing customer base, regardless of how long they’ve been clients.

The formula for NDR is:

NDR = (Starting ARR + Expansion Revenue - Revenue Lost) / Starting ARR x 100%

ARR stands for annual recurring revenue. You could also use monthly recurring revenue (MRR) for this if you want to calculate NDR each month.

Let’s explain how a company might calculate its net dollar retention (NDR) rate.

Imagine a company had 200 customers at the beginning of the year, each paying $200 per month. This generates a total annual recurring revenue (ARR) of $480,000.

Last year, the following events occurred:

- 30 customers (cohort A) upgraded their plans, each increasing their monthly subscription by $100, resulting in an additional ARR of $36,000. This is expansion revenue.

- 40 customers (cohort B) downgraded their plans, each decreasing their monthly subscription by $50, resulting in a loss of ARR of $24,000. This is contracted revenue.

- 10 customers (cohort C) canceled their subscriptions, resulting in a total loss of ARR of $24,000. This is revenue churn.

Note that cohorts are broken up by specific actions (upgrades, downgrades, and cancelations).

Now, we can calculate this company’s net dollar retention (NDR) rate:

NDR = (Starting ARR + Expansion Revenue - Contracted Revenue - Churned Revenue) / Starting ARR x 100

- Starting ARR (from existing customers): $480,000

- Expansion revenue (from cohort A): $36,000

- Contractions (from cohort B): -$24,000

- Churn (from cohort C): -$24,000

- NDR = $468,000 / $480,000 = 97.5%

In this example, NDR is 97.5%, which means that the company retained 97.5% of the revenue from their existing customers during the customers’ first year.

For more information on NDR benchmarks in SaaS, here’s a great resource.

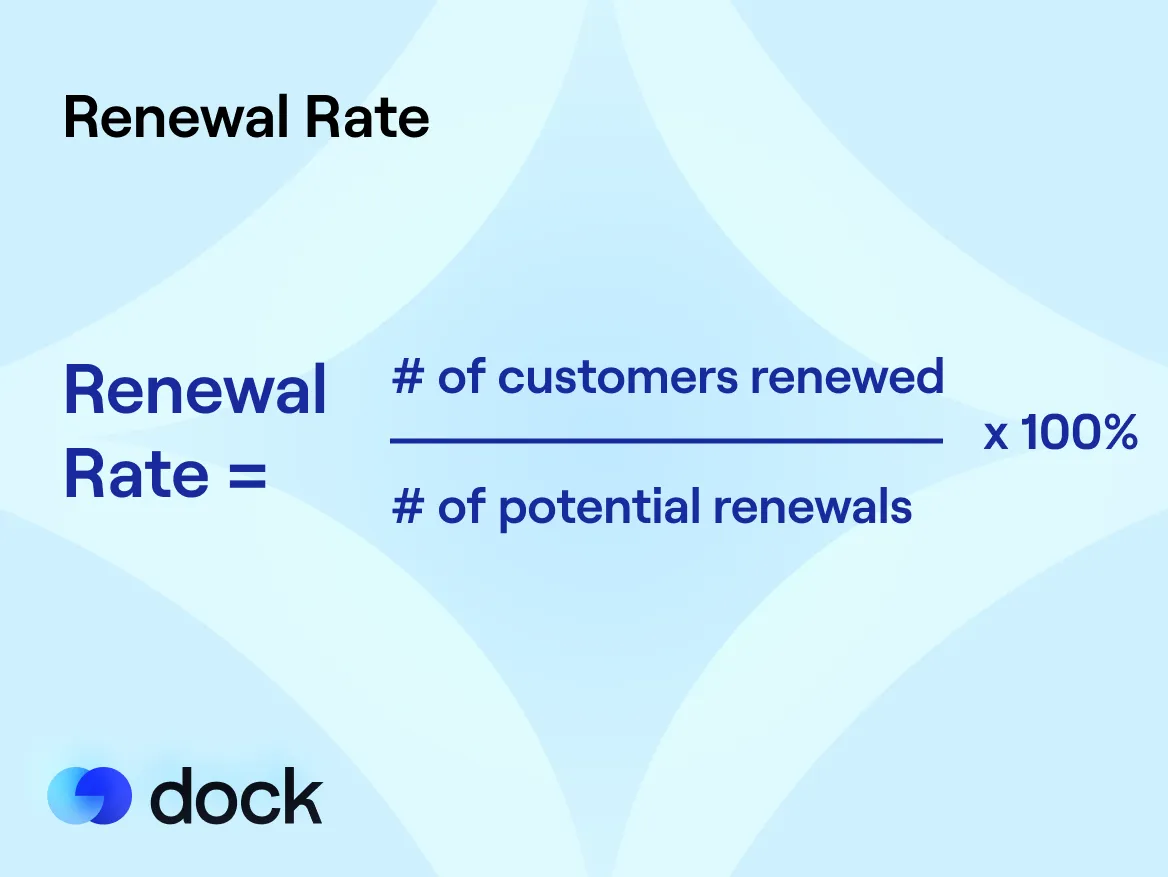

NRR vs. renewal rate

Renewal rate is a metric that focuses solely on the percentage of customers who renew their subscriptions or contracts over a specific period. Unlike NRR, renewal rate does not consider expansion revenue or lost revenue from downgrades.

Instead, it provides insights into the most basic level of customer retention, which can inform your strategy on how well the business maintains customer relationships.

The formula for renewal rate is:

Renewal Rate = # of Customers Renewed / # of Potential Customer Renewals x 100%

As you would expect, a high renewal rate indicates a strong ability to maintain existing customers, and a low renewal rate suggests that the business might need to improve customer retention.

Let’s imagine a company that wants to calculate renewal rates for the year's first quarter.

During this time, they had a total of 200 customers with annual subscriptions that were up for renewal. Of these 200 customers, 160 renewed their subscriptions for another year.

Now we can calculate this company’s renewal rate:

Renewal Rate = (Number of Customers Renewed) / (Number of Customers Up for Renewal) x 100%

- Renewal rate = 160 / 200 x 100%

- Renewal rate = 0.8 x 100%

- Renewal rate = 80%

In this example, the company has a renewal rate of 80% for the first quarter, which means they can still improve retention efforts, as 20% of customers decided not to renew their subscriptions.

Ok, but how are renewal rates different than NRR?

Renewal rates measure the percentage of customers who renew subscriptions or contracts over a specific period.

NRR is a more comprehensive metric that looks at customer retention and revenue changes from subscription upgrades, downgrades, and expansion revenue from existing customers.

NRR benchmarks: What is a good NRR?

A good NRR benchmark can vary depending on your industry and business model. That said, as a general rule, you’re aiming for an NRR at or above 100%. This means the company is maintaining or growing revenue from its existing customer base.

Here's a breakdown of NRR benchmarks to help you gauge your company's performance:

NRR below 100%

This indicates the company is losing revenue from its existing customer base due to customer churn or downgrades. An NRR below 100% is a red flag, and businesses should take action to improve customer retention and minimize revenue loss.

NRR at 100%

An NRR of exactly 100% means the company is maintaining its revenue from existing customers, and neither losing nor gaining additional revenue. While this is not a negative situation, businesses should still strive to increase their NRR to achieve growth from their current customers.

NRR between 100% and 120%

An NRR in this range is considered good, demonstrating the company is successfully growing its total revenue from existing customers. Companies with an NRR in this range are effectively upselling, cross-selling, and minimizing churn.

NRR above 120%

An NRR above 120% is considered excellent and indicates a strong ability to expand revenue from the existing customer base. Companies with an NRR in this range retain their customers and successfully increase their spending through upsells, cross-sells, and upgrades.

How to measure and track NRR

Measuring and tracking NRR is a great way to better understand how well your business retains and grows revenue from its existing customer base.

Here's a step-by-step process on how to measure and track NRR:

- Define the period: Determine the time period you want to measure NRR for, such as monthly or yearly.

- Calculate the starting MRR/ARR: Calculate your monthly or annually recurring revenue (MRR/ARR) at the beginning of this time period.

- Calculate expansion revenue: Expansion revenue includes any additional revenue generated from existing customers during the period through upgrades, upsells, and cross-sells. It doesn’t include revenue from new customers.

- Calculate revenue lost: Revenue lost is the revenue lost from existing customers during the period. This can come from downgrades (customers moving to lower-tier plans), cancellations, or churn (customers not renewing their subscriptions).

- Apply the NRR formula: Using the calculated values, apply the NRR formula.

- Track NRR over time: Monitor and record your NRR regularly, such as monthly or quarterly, to track its performance. This will help you identify trends and gain insights into the effectiveness of your customer retention and growth strategies.

- Analyze and take action: Use your NRR measurements to assess your company's performance and identify areas for improvement.

If NRR is below 100%: focus on reducing churn and downgrades while exploring opportunities to upsell or cross-sell to existing customers.

If your NRR is above 100%: continue refining your strategies to maintain and further grow revenue from your existing customer base.

How to improve NRR

Now, let’s look at how to improve NRR and generate more revenue from your existing customers.

1. Customer onboarding

Improving customer onboarding can significantly and directly impact net retention revenue.

Here’s how:

- Achieve faster time to value: An effective onboarding process ensures that customers quickly understand the value of the product or service they've purchased. They are more likely to remain loyal customers when they can easily access your product’s benefits.

- Decrease churn: A seamless onboarding experience reduces friction and potential roadblocks that may cause customers to abandon the product before fully adopting it.

- Increase upselling and cross-selling opportunities: When customers have a positive onboarding experience, they are more open to exploring additional products or services offered by the company. This presents an opportunity to upsell or cross-sell, further increasing net retention revenue.

- Strengthen brand loyalty: A successful onboarding process helps build customer trust and credibility. When customers feel valued and supported, they’re more likely to become die-hard brand advocates.

Improving customer onboarding is a crucial investment for businesses looking to maximize net retention revenue.

How to streamline customer onboarding with Dock

Most companies know the value of successful customer onboarding. What they don’t know is how to pull it off efficiently.

Rather than keeping everything organized in a single platform, their teams end up scattering client onboarding across spreadsheets and project management tools.

But these tools weren’t built for premium-feeling client interactions. They’re clunky and lead to important messages getting lost in back-and-forth emails.

That’s why we recommend working with a simple but powerful customer onboarding portal like Dock.

Dock lets you move away from clunky spreadsheets to build a frictionless customer onboarding experience. You’ll work from a collaborative workspace, so your most valuable onboarding docs get the attention and vision they deserve.

Here’s a look at some of the ways Dock helps your team onboard:

- Make onboarding checklists: Eliminate the confusion and friction from your onboarding process by guiding customers with clear, concise steps.

- Track engagement: Understand how customers are progressing through their customer journey and gather insights into where engagement needs your attention.

- Embed tutorials and walkthroughs: Add PDFs, images, videos and more to help customers get the best results from your product.

- Contain communication to one place: Most teams work across spreadsheets and project management tools. Centralize communication to stop important messages from slipping through the cracks.

- Collect feedback: Understand what your customers love, hate, and everything in between by getting feedback throughout the onboarding process.

- Duplicate customer spaces: Copy work from a single customer in a single click to create multiple onboarding spaces in less time.

- Share information securely: Add passwords to protect spaces and ensure your client’s (and your) data is always protected.

In other words, Dock just makes onboarding easy.

And since Dock comes with pre-made onboarding templates, you can build an onboarding workflow without bogging down your CS and implementation teams—because, let’s face it, they’re already swamped.

💻 Compare onboarding software: To learn more about onboarding tools, check out our Customer Onboarding Software Guide.

2. Customer renewals

Getting more customer renewals is critical in improving net retention revenue (NRR). By securing more customer renewals, businesses can positively impact their NRR in several ways:

- Increase customer lifetime value (CLV): When customers renew their contracts or subscriptions, they extend their relationship with the company, increasing their lifetime value.

- Lower acquisition costs: Acquiring new customers can be expensive and time-consuming. Renewals allow companies to allocate resources more effectively, leading to increased profitability and a better NRR.

- Earn word-of-mouth referrals: Happy customers who renew are more likely to refer others to the company. Word-of-mouth marketing can significantly contribute to a business's growth, as it’s more effective and cost-efficient than other marketing methods.

But getting more customers to renew is already the goal for most businesses. Like most readers, what you really want to know is how to help them do it.

How to increase customer renewals with Dock

Boosting customer renewals is the result of a seamless four-step process:

- Onboarding (which we covered in the last step)

- Adoption: Ensuring customers fully utilize your product

- Nurture: Looking after your customers

- Renewal: Encouraging customers to renew

Dock empowers you to boost renewal rates from day one by enhancing the entire customer journey.

The secret lies in our ability to create collaborative workspaces tailor-made for your entire team, streamlining the customer journey like never before. Here's how it works:

- Collaborative workspaces serve as a tangible record of the sales process, enabling a smooth handover from the sales team to customer success.

- Better tracking during onboarding results in increased product adoption, ensuring that customers see fast time to value

- The workspace acts as a repository of value over time, making it an ideal tool for business reviews and showcasing your product's impact

- When renewal time rolls around, the workspace transforms into a sales space, making it easy to illustrate the benefits of continued partnership.

With Dock, you have everything you need to optimize renewals and enhance your customers' experience throughout their journey.

Everything about Dock is geared to improve revenue enablement, which is often challenging because many modern tools aren’t built for cross-team collaboration.

3. Customer enablement

Better customer enablement can increase NRR by empowering customers to get the most from your product or service, leading to higher satisfaction and long-term loyalty.

Customers are more likely to renew their subscriptions and explore additional offerings when they are well-equipped with the knowledge to succeed.

Here's how better customer enablement can boost NRR:

- Boost product adoption: When customers can use a product or service effectively, they are more likely to adopt and integrate it into their daily workflows fully. This leads to higher satisfaction, lower churn rates, and a higher NRR.

- Reduce churn: Well-enabled customers are likelier to stick around, as they can fully appreciate the value of the product or service they've invested in.

- Enhance customer satisfaction: When customers feel supported and empowered to succeed with a product or service, their overall satisfaction increases. Satisfied customers are more likely to renew their contracts, recommend the company to others, and be receptive to upselling and cross-selling opportunities, all of which contribute to higher NRR.

When you empower customers to use a product or service successfully, you can significantly boost NRR and promote long-term growth.

How to improve customer enablement with Dock

The first thing you should do is check out Dock’s customer success plan.

This is a templated success plan for SaaS companies and startups who want to increase product adoption. Building out this plan has tons of benefits and will help you:

- Develop a transparent customer success plan for your clients and team members

- Streamline your customer success approach, removing obstacles for everyone involved

- Implement an uncomplicated customer success system to promote product use

- Ensure clients stay focused on accomplishing their business objectives

- Effortlessly tailor the experience to suit your customers' needs

- Bring customer success managers (CSMs) and clients together to make their mutual goals align

This battle-tested customer success plan template not only streamlines customer success processes but also creates a clear roadmap for both customers and team members.

By implementing a simple process to encourage product usage in a single place, Dock enables you to personalize the experience for your customers, align your team’s goals/strategies, and focus on customer retention through support.

As a result, your customers will have a better experience with your services, leading to higher retention and, ideally, deeper brand loyalty.

Ready to build your own customer success plan?

Create your first 5 Dock workspaces for free and see how quickly you experience the benefits of building a frictionless user journey.